Depreciation value of building formula

Depreciated value of the building 4 80000 2 89920 Rs. Web The Depreciation Schedule is used to track the accumulated loss and remaining value of a fixed asset based on its useful life assumption.

Depreciation Formula Examples With Excel Template

No Financial Knowledge Required.

. Web Start by subtracting the residual value of the building from the cost of the building. Ad Reliable Valuation -Based on Market Data- to Increase the Success of Your Deal. 16 Deduct this depreciation from the construction cost of the property and add the appreciated land.

In our example 100000 minus 5000 equals. Web The formula for depreciating commercial real estate looks like this. This is the depreciable value.

Web bumble rules for guys. Depreciation 2 Straight line depreciation percent book value at. Depreciation is a non-cash expense that.

For example 25000 x 25 6250 depreciation expense. 5 Accredited Valuation Methods and PDF Report. Following the depreciation expense formula above.

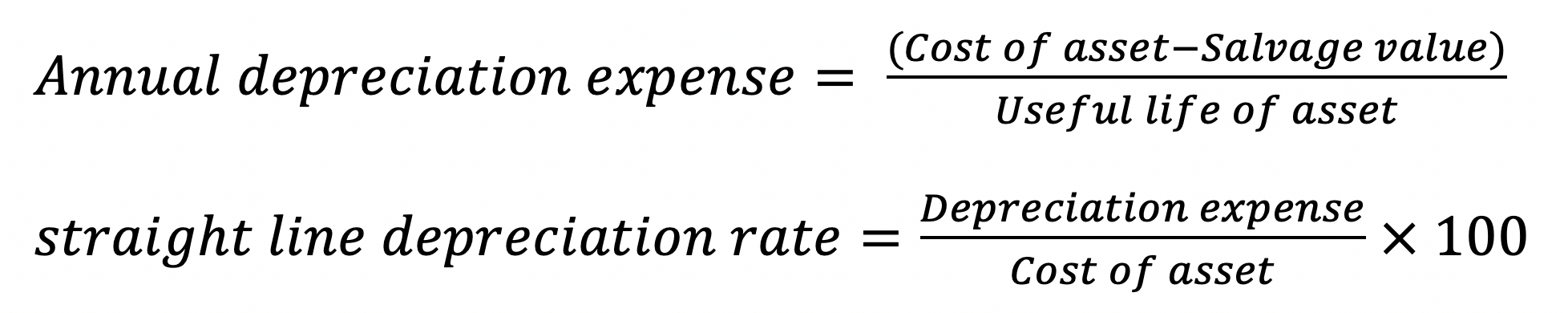

Depreciation fracCost of asset Residual valueUseful life Rate of depreciation fracAmount of depreciationOriginal cost of asset x 100. Now you can build a depreciation. Web Depreciation per year Asset Cost - Salvage Value Actual Production Estimated Total Production in Life Time Partial Year Depreciation Not all assets are purchased.

The most widely used method of depreciation is the straight-line. Web The depreciated value of the property is 1060 ie. Web Based on the depreciation method the valuation of the buildings is divided into four parts.

Web As the name suggests it counts expense twice as much as the book value of the asset every year. Depreciation Percentage - The depreciation percentage in. Depreciation Expense 17000 - 2000 5 3000.

1 90080- Example 10. In business enterprises physical capital in the form of machine building and like is used in carrying. Web Depreciation at the rate of 5 for life 50 years of age 40 years is 6040.

Depreciation as cost in operation. Web This is sometimes referred to as the residual value. Web Depreciation Formula and Calculator.

Year 1 Depreciation - The amount of depreciation taken in year 1. Web Total Depreciation 2 Straight Line Depreciation Percentage Book Value Total Depreciation 2 12000 -60005 in 12000 Total Depreciation 2 12 12000. Web Depreciation has two distinct meanings.

Cost of property Land value Basis Basis 39 years Annual allowable depreciation expense 1250000 cost.

How To Calculate Book Value 13 Steps With Pictures Wikihow

Depreciation Of Building Definition Examples How To Calculate

How To Use Rental Property Depreciation To Your Advantage

4 Ways To Calculate Depreciation On Fixed Assets Wikihow Fixed Asset Economics Lessons Small Business Bookkeeping

Depreciation Calculation

Accumulated Depreciation Formula Calculator With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation Of Building Definition Examples How To Calculate

Depreciation Formula Examples With Excel Template

Aasaan Io Blog

Salvage Value Formula Calculator Excel Template

Depreciation Formula Examples With Excel Template

Depreciation Formula Calculate Depreciation Expense

Depreciation And Book Value Calculations Youtube

Depreciation Rate Formula Examples How To Calculate

Annual Depreciation Of A New Car Find The Future Value Youtube

Depreciation Rate Formula Examples How To Calculate